- Data Analytics

- Visual Design

Environmental, social and governance (ESG) concerns are now common issues that companies have to address. They cover a wide range of issues and aim to improve the impact of business on the environment. In our mini-series, we show you what you need to pay attention to in your company in the future.

Text: Andrew Ball & Björn Leffler

In the first part, we looked at the definition of ESG and the need for ESG reporting. In the second part of our mini-series, we look at the different roles of employees and teams and the definition of concrete ESG KPIs for your company.

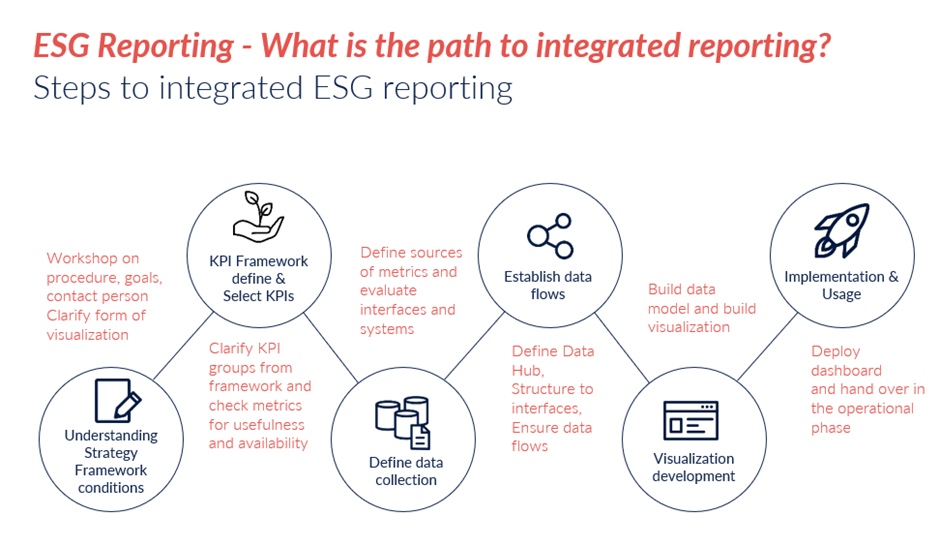

Given the potential increase in business value, it is important to ensure that ESG reporting rollouts are done strategically to unlock the most value. M2 has developed a framework to support such rollouts. By working with organizations that follow this framework, the time to implementation is significantly reduced.

While the overall ESG topic is broad, reporting should be built piece by piece, with each piece leading to a better understanding of a company's structure. One such piece, which was the focus of a recent M2 project, was the topic of diversity. After all, diversity in companies is a topic that has become increasingly important in recent years, with discussions about the gender pay gap being a notable example.

With a topic as emotive as salary and merit, it is important that companies are responsible with the data they are provided with and ensure that the reporting of this data is fair and transparent. In order to proceed with the project addressed above, it was first necessary to define the metrics to be measured.

The metrics in this case involved two cases:

In addition to the main metrics, meaningful reporting requires enough other attributes to break down the data and draw insights and conclusions. When reporting on diversity in the organization, the project focused on the details of the employee's function rather than the employee themselves. This ensured that the quality of the data remained high, as this work role data is proprietary to the organization and thus can be used, unlike personal information, which is generally much less complete:

Once the data was collected, the next step was to confirm KPIs that were both consistent with the ESG policy and realistic. After all, if a goal is too unrealistic, it will lead to constant missed targets, which lowers an organization's morale and makes the ESG policy something to struggle with rather than be happy about.

These KPIs may include:

The metrics were looked at over a longer period of time in the project, which allowed for evidence of an improvement process. Understandably, tracking the evolution of a company's workforce structure, where an individual may have been in a role for many years, requires data points over several years. This can be a hurdle for some companies, as ESG policies generally require strategic policy changes, as opposed to short-term changes.

Fortunately, in the example discussed, the data was available over several years, although the quality declined the further back the data points were. This meant that algorithms had to be developed to normalize the data and ensure that the use of historical data provided realistic insight. At the same time, processes were put in place to ensure that data was properly captured, and overall ESG reporting was improved to demonstrate appropriate data quality.

There were a number of considerations to take into account during the course of the project. All items were presented to the client with recommendations on how to proceed to ensure that the reporting results were consistent with their ESG policies.

These included, but were not limited to, the following issues:

The creation of the Diversity ESG Reporting provided a critical look into the structure of the company and highlighted the inequality in hiring across different departments. The profile of employees in a sales department may be different from those in an HR department. This can mean that while a company has good diversity overall, individual teams and departments have little to no diversity, resulting in an elitist or exclusionary environment.

Some positions, such as at the C-level, are traditionally male-dominated. Although current trends show that this situation is already improving, there is still a long way to go before gender equality is achieved. While it may be difficult to find suitable candidates in the short term, ESG reporting can show how a company is encouraging female employees to move up and retaining the talent to provide suitable candidates in the long term.

While the EU mandates a strict ESG policy, this is not always the case in other countries and regions of the world. Local culture dictates diversity requirements, and there may be a strong cultural bias against a non-diverse workforce. While it is important to consider this cultural diversity, well-implemented ESG reporting should provide clarity to the organization and reflect ESG policies.

By working within a framework, exceptions or cultural differences can be clearly accounted for, and the goal should always be to provide clarity on KPIs so that ESG reporting can focus on progress and advancement within the organization.

Do you have any questions about this article or about M2? Then please feel free to contact us at any time. We look forward to exchanging ideas with you.

Your M2 Team

Phone: +49 (0)30 20 89 87 010

info@m2dot.com